Headlines Today

-

![]() When the ATM Makes a Mistake: What to DoThe accuracy of ATMs is not guaranteed. When they do, the cost of time and resources to rectify the situation can be significant.

When the ATM Makes a Mistake: What to DoThe accuracy of ATMs is not guaranteed. When they do, the cost of time and resources to rectify the situation can be significant. -

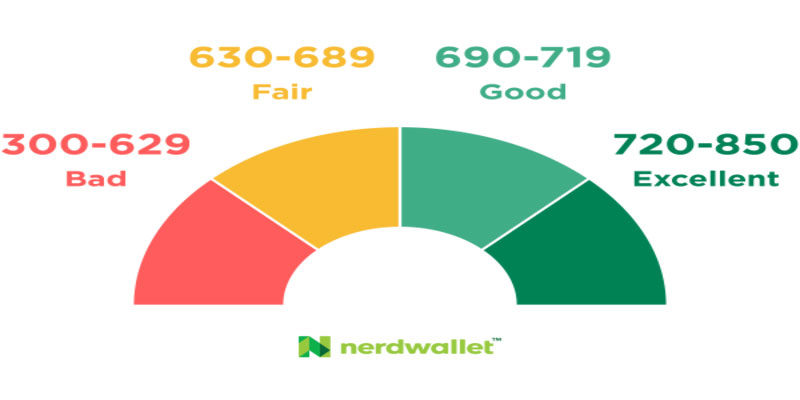

![]() What Are the Ranges for Credit Scores?Your creditworthiness is quantified by your credit score, which creditors use to assess the risk of lending you money. A higher credit score (from 300 to 850) indicates you are more likely to make timely debt payments. Your credit score must be elevated to be approved for a loan, credit card, or other financial instrument.

What Are the Ranges for Credit Scores?Your creditworthiness is quantified by your credit score, which creditors use to assess the risk of lending you money. A higher credit score (from 300 to 850) indicates you are more likely to make timely debt payments. Your credit score must be elevated to be approved for a loan, credit card, or other financial instrument. -

![]() Build a Holiday Budget That Works Every YearEstablishing spending categories and starting your savings early will help you avoid unpleasant and costly shocks and avoid a spending hangover after the holidays.

Build a Holiday Budget That Works Every YearEstablishing spending categories and starting your savings early will help you avoid unpleasant and costly shocks and avoid a spending hangover after the holidays. -

![]() How getting a store card will affect your creditCan you tell me how a retail credit card application will affect my credit rating? Provides the most thorough information available on the subject of applying for a store card. This course will educate anyone interested in applying for a shop credit card on the process and the potential effects on their credit rating.

How getting a store card will affect your creditCan you tell me how a retail credit card application will affect my credit rating? Provides the most thorough information available on the subject of applying for a store card. This course will educate anyone interested in applying for a shop credit card on the process and the potential effects on their credit rating. -

![]() How Is The U.S. Bank Altitude Different From The Capital One Savor?For those who like eating out often, two excellent credit cards are the U.S. Bank Altitude® Go Visa Signature® Card and the Capital One Savor Cash Rewards Credit Card. The Capital One Savor Cash Rewards Credit Card has a $95 annual fee. Still, the increased rewards you may earn in common spending areas, including grocery shops, entertainment, and streaming services, may be worth it for many cardholders.

How Is The U.S. Bank Altitude Different From The Capital One Savor?For those who like eating out often, two excellent credit cards are the U.S. Bank Altitude® Go Visa Signature® Card and the Capital One Savor Cash Rewards Credit Card. The Capital One Savor Cash Rewards Credit Card has a $95 annual fee. Still, the increased rewards you may earn in common spending areas, including grocery shops, entertainment, and streaming services, may be worth it for many cardholders. -

![]() Sanctions and SWIFT: How the Global Banking System Affects International RelationsSWIFT, which stands for the Society for Worldwide Interbank Financial Telecommunication, is an organization that facilitates secure and efficient communication between financial institutions worldwide. Despite not executing transactions or holding assets, the billions of messages sent daily via SWIFT ensure the safe and timely completion of various financial activities

Sanctions and SWIFT: How the Global Banking System Affects International RelationsSWIFT, which stands for the Society for Worldwide Interbank Financial Telecommunication, is an organization that facilitates secure and efficient communication between financial institutions worldwide. Despite not executing transactions or holding assets, the billions of messages sent daily via SWIFT ensure the safe and timely completion of various financial activities -

![]() How To Consolidate Credit Card Debt on Your Own: An overviewConsolidating credit card debt with a personal loan can work well for you, depending on your current financial circumstances.

How To Consolidate Credit Card Debt on Your Own: An overviewConsolidating credit card debt with a personal loan can work well for you, depending on your current financial circumstances.

-

![Differences Between Demand-Pull and Cost-Push Inflation]() Differences Between Demand-Pull and Cost-Push InflationThis article compares and contrasts two types of inflation: demand-pull and cost-push. Find out the key difference between both.

Differences Between Demand-Pull and Cost-Push InflationThis article compares and contrasts two types of inflation: demand-pull and cost-push. Find out the key difference between both. -

![Putting Together a Solid Will and Estate Plan]() Putting Together a Solid Will and Estate PlanCreate a list of your assets and an estimate of their total value. Identify the beneficiaries, as well as an executor. If you ever find yourself unable to handle your own finances or medical care, you should name someone to act as your power of attorney and make decisions on your behalf.

Putting Together a Solid Will and Estate PlanCreate a list of your assets and an estimate of their total value. Identify the beneficiaries, as well as an executor. If you ever find yourself unable to handle your own finances or medical care, you should name someone to act as your power of attorney and make decisions on your behalf. -

![What Is Bank Reconciliation?]() What Is Bank Reconciliation?In most cases, reconciliations are performed monthly to verify that all transactions, including deposits, withdrawals, and bank fees, are properly accounted for. It is very uncommon for a company's book balance to differ from the amount shown on its bank statement; nonetheless, the company must account for these differences and modify the general ledger appropriately.

What Is Bank Reconciliation?In most cases, reconciliations are performed monthly to verify that all transactions, including deposits, withdrawals, and bank fees, are properly accounted for. It is very uncommon for a company's book balance to differ from the amount shown on its bank statement; nonetheless, the company must account for these differences and modify the general ledger appropriately. -

![Noncash Expenses]() Noncash ExpensesExpenses that do not involve the physical movement of cash from one party's bank account to another party's bank account are referred to as noncash expenses.

Noncash ExpensesExpenses that do not involve the physical movement of cash from one party's bank account to another party's bank account are referred to as noncash expenses. -

![Waiver of Premium Rider]() Waiver of Premium RiderAccording to the provisions of an optional rider that can be added to your insurance policy, the insurance company may reckon to waive your premium after a preliminary waiting period if you become disabled until you reach a certain age, such as 60 or 65. This would be in accordance with the terms of your insurance policy. A waiver of premium rider is the name given to this kind of rider.

Waiver of Premium RiderAccording to the provisions of an optional rider that can be added to your insurance policy, the insurance company may reckon to waive your premium after a preliminary waiting period if you become disabled until you reach a certain age, such as 60 or 65. This would be in accordance with the terms of your insurance policy. A waiver of premium rider is the name given to this kind of rider. -

![Does Hiding A Car to Avoid Repossession Work: Explain?]() Does Hiding A Car to Avoid Repossession Work: Explain?Most states allow car loan creditors access to private property to repossess collateralized vehicles without requiring the use of force (such as cutting chains or breaking locks). Therefore, the creditor may still be able to repossess your vehicle even if you "hide" it by parking it behind your house or garage or in the woods on your land.

Does Hiding A Car to Avoid Repossession Work: Explain?Most states allow car loan creditors access to private property to repossess collateralized vehicles without requiring the use of force (such as cutting chains or breaking locks). Therefore, the creditor may still be able to repossess your vehicle even if you "hide" it by parking it behind your house or garage or in the woods on your land. -

![Ways to Build a Business General Ledger]() Ways to Build a Business General LedgerA general ledger is a book of accounts used by businesses to keep track of their money. All of a company's financial dealings are recorded there, neatly categorised into balance sheet accounts and income statement accounts

Ways to Build a Business General LedgerA general ledger is a book of accounts used by businesses to keep track of their money. All of a company's financial dealings are recorded there, neatly categorised into balance sheet accounts and income statement accounts