-

![]() When the ATM Makes a Mistake: What to DoThe accuracy of ATMs is not guaranteed. When they do, the cost of time and resources to rectify the situation can be significant.

When the ATM Makes a Mistake: What to DoThe accuracy of ATMs is not guaranteed. When they do, the cost of time and resources to rectify the situation can be significant. -

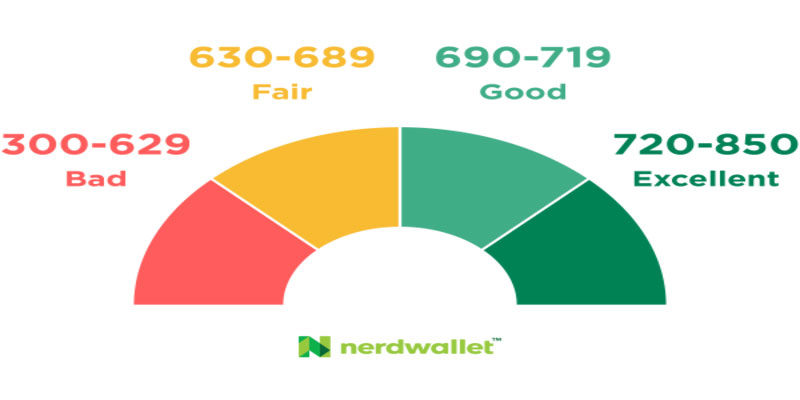

![]() What Are the Ranges for Credit Scores?Your creditworthiness is quantified by your credit score, which creditors use to assess the risk of lending you money. A higher credit score (from 300 to 850) indicates you are more likely to make timely debt payments. Your credit score must be elevated to be approved for a loan, credit card, or other financial instrument.

What Are the Ranges for Credit Scores?Your creditworthiness is quantified by your credit score, which creditors use to assess the risk of lending you money. A higher credit score (from 300 to 850) indicates you are more likely to make timely debt payments. Your credit score must be elevated to be approved for a loan, credit card, or other financial instrument. -

![]() How getting a store card will affect your creditCan you tell me how a retail credit card application will affect my credit rating? Provides the most thorough information available on the subject of applying for a store card. This course will educate anyone interested in applying for a shop credit card on the process and the potential effects on their credit rating.

How getting a store card will affect your creditCan you tell me how a retail credit card application will affect my credit rating? Provides the most thorough information available on the subject of applying for a store card. This course will educate anyone interested in applying for a shop credit card on the process and the potential effects on their credit rating. -

![]() How Is The U.S. Bank Altitude Different From The Capital One Savor?For those who like eating out often, two excellent credit cards are the U.S. Bank Altitude® Go Visa Signature® Card and the Capital One Savor Cash Rewards Credit Card. The Capital One Savor Cash Rewards Credit Card has a $95 annual fee. Still, the increased rewards you may earn in common spending areas, including grocery shops, entertainment, and streaming services, may be worth it for many cardholders.

How Is The U.S. Bank Altitude Different From The Capital One Savor?For those who like eating out often, two excellent credit cards are the U.S. Bank Altitude® Go Visa Signature® Card and the Capital One Savor Cash Rewards Credit Card. The Capital One Savor Cash Rewards Credit Card has a $95 annual fee. Still, the increased rewards you may earn in common spending areas, including grocery shops, entertainment, and streaming services, may be worth it for many cardholders. -

![]() Sanctions and SWIFT: How the Global Banking System Affects International RelationsSWIFT, which stands for the Society for Worldwide Interbank Financial Telecommunication, is an organization that facilitates secure and efficient communication between financial institutions worldwide. Despite not executing transactions or holding assets, the billions of messages sent daily via SWIFT ensure the safe and timely completion of various financial activities

Sanctions and SWIFT: How the Global Banking System Affects International RelationsSWIFT, which stands for the Society for Worldwide Interbank Financial Telecommunication, is an organization that facilitates secure and efficient communication between financial institutions worldwide. Despite not executing transactions or holding assets, the billions of messages sent daily via SWIFT ensure the safe and timely completion of various financial activities -

![]() What Is Bank Reconciliation?In most cases, reconciliations are performed monthly to verify that all transactions, including deposits, withdrawals, and bank fees, are properly accounted for. It is very uncommon for a company's book balance to differ from the amount shown on its bank statement; nonetheless, the company must account for these differences and modify the general ledger appropriately.

What Is Bank Reconciliation?In most cases, reconciliations are performed monthly to verify that all transactions, including deposits, withdrawals, and bank fees, are properly accounted for. It is very uncommon for a company's book balance to differ from the amount shown on its bank statement; nonetheless, the company must account for these differences and modify the general ledger appropriately. -

![]() Lockbox Banking: What Is It?Your staff members are probably wondering what a lockbox is, given the fast development in corporate payments technology. Commercial banks provide lockbox services to facilitate the flow of business transactions and speed up the collection and processing of account receivables for their customers.

Lockbox Banking: What Is It?Your staff members are probably wondering what a lockbox is, given the fast development in corporate payments technology. Commercial banks provide lockbox services to facilitate the flow of business transactions and speed up the collection and processing of account receivables for their customers.